Garrett Kirk ’24

News Editor

Nearly a year has passed since the significant financial changes brought on the pandemic, thus the Tripod undertook an examination of the state of Trinity’s finances over that time.

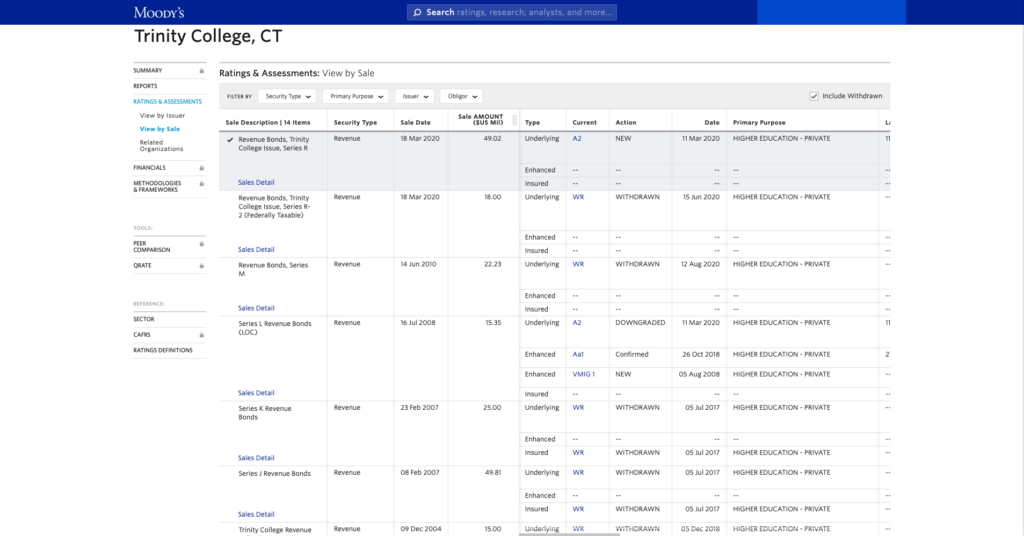

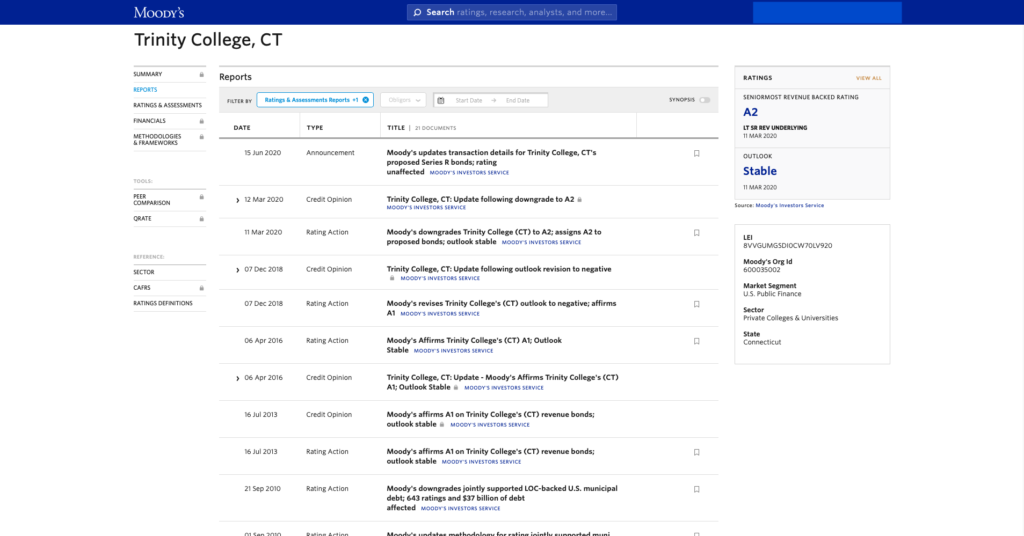

In March of 2020, per Moody’s Investment Services, Trinity’s bond rating was downgraded one notch, from an A1 to an A2. Trinity’s bond rating is at the lower end of the NESCAC peer group, sharing A2 status with Connecticut College. Amherst leads all schools with a rating of Aaa, followed by Williams possessing an Aa1 classification, while Hamilton, Colby, Bowdoin, and Tufts all have Aa2 recognition. Below this foursome lies Middlebury and Wesleyan with grades of Aa3. Despite being rated higher than Trinity, Middlebury is the only NESCAC school on the list with a negative outlook. Bates lies slightly above Trinity and Conn, possessing an A1 status. It’s important to note that all of the NESCAC schools– including Trinity–fall under what Moody’s calls the “investment grade” category, which is its highest debt rating.

One report from Moody’s at the time of the downgrade said that “[t]he downgrade is driven by the heightened competitive challenges that will continue to suppress revenue growth and pricing flexibility. As a result, the College’s operating performance and debt affordability will weaken for a third consecutive year in fiscal 2020. Restoration of stronger operating cash flow margins is unlikely over the next several years due to ongoing low revenue growth and limited plans for expense reductions.”

Despite the downgrade, Trinity’s bond outlook remains stable. Moody’s additionally said that “[t]he stable outlook reflects our expectations that financial operations will stabilize in fiscal 2021 at low double-digit operating cash flow margins with no material deductions in operating liquidity.”

There were three factors cited by Moody’s that have the potential to improve the school’s bond rating, which were “[d]emonstration of ability to sustainably increase operating revenue above 3%, [s]ubstantial increase in unrestricted reserves and liquidity, and material improvement in operating cash flow margins and debt affordability.”

News of the bond downgrade came as the school was also facing declines in the value of its endowment assets. During fiscal year 2020 (June 2019-June 2020), Trinity’s endowment decreased by 3.87% according to the 2020 NTSE Endowment Market Values Data. According to this data, Trinity’s endowment was $605 million as of June 30, 2020, which puts the school in the bottom quartile of its NESCAC peers.

While the value of the College’s endowment and its bond rating are on the lower end of the NESCAC, the College has also indicated some belief in opportunities for growth. Chief of Staff and Associate Vice President for External Affairs Jason Rojas said that “Trinity College’s Endowment pool has enjoyed an overall positive 14.6% return since June 30, 2020, with global equities leading the way with gains of 19.2%. The value of the College’s endowment was $656.6 million as of December 31, 2020.”

Rojas also continued by saying that “we continue to be optimistic about the current fiscal year budget that ends June 30th and expect to end the year on budget.”

The Tripod reached out to Rojas for comment on Trinity’s Moody’s rating in January. He declined to comment, adding that the College “will not offer comment on questions given the dated nature of the inquiry” while pointing out “that rating agencies noted a negative outlook for the entire higher education sector given the fiscal challenges the sector has faced because of COVID.”

Despite current economic challenges, the administration nonetheless made the decision not to raise tuition for the 2020-2021 school year. As a result, Trinity has gone from being the most expensive school in the NESCAC to about median in relation to other NESCAC institutions. The Board of Trustees is expected to vote on a potential tuition increase for the 2021-2022 academic year at the April Board of Trustees meeting and also consider ongoing capital improvement concerns.

+ There are no comments

Add yours